The Central bank raised momentary financing costs Wednesday by 0.50%, bringing benchmark loan fees to the most significant level beginning around 2007 while recommending more rate climbs are coming in 2023.

Wednesday’s move brings the Fed finances rate to a scope of 4.25%-4.5%, covering a year that saw the national bank raise rates by an aggregate 4.25%.

Wednesday’s 50 premise point rate climb denoted a stoppage from the Federal Reserve’s new speed of rate climbs, as the national bank had raised rates by 75 premise focuses at every one of its beyond four strategy gatherings — its generally forceful stretch since the 1980s.

“Throughout the year, we have made intense moves to fix the position of financial arrangement,” Took care of seat Jerome Powell said on Wednesday. “We take care of a ton of ground, and the full impacts of our fast fixing so far are yet to be felt. All things being equal, we have more work to do.”

In it is all up to assertion reporting Wednesday, the national bank included phrasing which said it expects “progressing increments” in loan fees, suggesting the Fed doesn’t plan to stop rate climbs unavoidably.

“The Council guesses that continuous expansions in the objective reach will be proper to accomplish a position of financial strategy that is adequately prohibitive to return expansion to 2 percent over the long run,” the Federal Reserve’s assertion said.

New financial estimates from the Fed distributed Wednesday show authorities presently see benchmark loan fees cresting at 5.1% in 2023, an additional 50 premise focuses higher than the recently projected 4.6% back in September. Authorities then see rates boiling down to 4.1% in 2024, somewhat higher than recently anticipated.

These projections come after Took care of Seat Jerome Powell said at the last gathering that rates should move higher than past projections in September.

Seven authorities see rates increasing higher than 5% one year from now — with five grouping around 5.25% and two seeing rates topping as high as 5.6% one year from now.

Authorities don’t see center expansion coming down near focus until 2024, with expansion balancing this year at 4.8% prior to tumbling to 3.5% one year from now and 2.5% in 2024.

Authorities see joblessness ascending to 4.6% one year from now and staying at that level through 2024. The Fed sees sub-optimal financial development, with the economy scarcely developing one year from now at only 0.5% prior to getting somewhat to 1.6% in 2024.

Asked during a public interview on Wednesday whether these estimates — with easing back development and rising joblessness — propose the Fed would endure the economy tipping into a downturn, Powell said, “I don’t figure it would qualify as a downturn, since you have positive [GDP] development.”

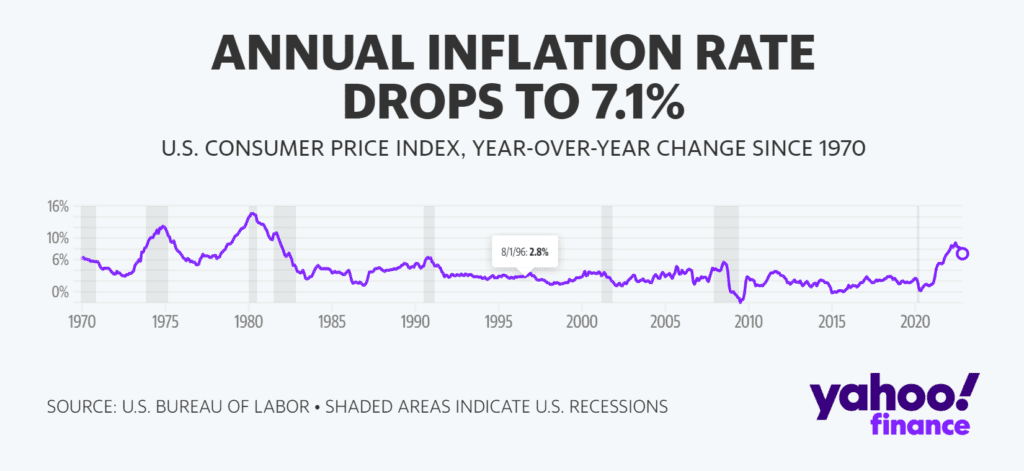

The Federal Reserve’s move comes as expansion has begun to indicate that things are pulling back the beyond two months subsequent to hitting a 40-year high this spring. The Buyer Value List, barring the more unstable food and energy parts, rose 0.2% month-on-month in November, down from 0.3% in October and 0.6% in September and August.

“The expansion information got such long ways for October and November show a welcome decrease in the month-to-month speed of cost builds,” Powell said. “In any case, it will take significantly more proof to give certainty that expansion is on a supported descending way.”